Regional Property Market Update Winter 2023: North East, Yorkshire and the Humber

Posted on: Thursday, December 7, 2023

As 2023 draws to a close, the economic backdrop is slowly and steadily uplifting, with the housing market proving its resilience. Mortgage rates are normalising but buyers and sellers remain cautious.

Brightening picture

Inflation experienced the sharpest decline in three decades, falling to 4.6% in October from 6.7% in September, now at its lowest rate since November 2021 (ONS). The economy is growing and incomes are rising, with wage growth at 7.7% in Q3 (ONS). With encouraging news, there has been an uptick in consumer confidence, increasing six points in November to -24, with improvements across all measures (GfK Consumer Confidence Tracker). The pace of house price moderation also appears to be steadying, with a net balance of 63% of property professionals reporting house prices falling in October, down from 67% in September (RICS).

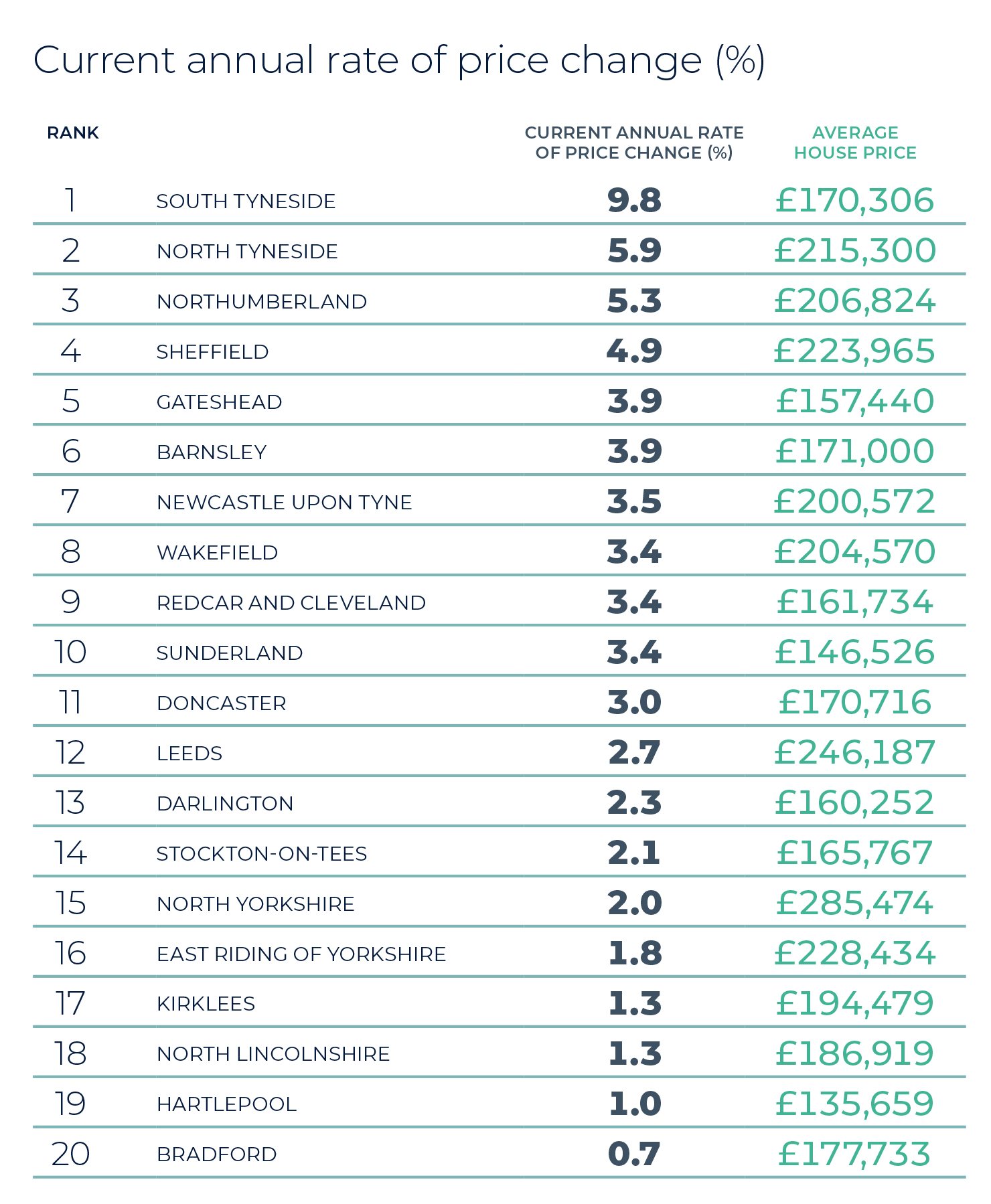

Across the North East, and Yorkshire and the Humber, the most active housing markets are currently those of Hartlepool, North Tyneside and County Durham, where over one in every 30 properties has changed hands in the past year.

The sentiment is that mortgage rates may have peaked, attracting those who delayed moving over the last year. We are in a strong buyer’s market, with sellers becoming more realistic and agreeing to larger discounts. The average discount on house prices reached 5.5% in November, equivalent to £18,000 and its highest level for more than five years. Some sellers are accepting even larger discounts, with one in four sales agreed having more than a 10% discount on the asking price (Zoopla). Given the price sensitivity, understanding local market dynamics and pricing realistically are crucial to successfully securing a sale.

In the Autumn Statement, the Chancellor announced cuts to employee National Insurance from 12% to 10%, saving the average earner £450 per year. Reductions to National Insurance for the self-employed have also been announced, affecting an estimated 39% of landlords with five or more properties. The government has committed to supporting the building of more homes, extending the mortgage guarantee scheme and increasing the national living wage. Long-awaited reforms to the leasehold system have started their progress through Parliament, with new laws promising ‘significant new rights and protections’ that could be in motion before the next General Election.

Average rents continue to rise on an annual basis, reaching £1,279 in November, although there has been a slight month-on-month fall of 0.3% (HomeLet). Void periods increased from 14 to 18 days, indicating a seasonal cooling in demand after a hectic summer period (Goodlord). However, the market remains under strain, with 17% of agents reporting that renters are often offering above asking rent, with a further 44% saying they do so sometimes (Dataloft Poll of Subscribers). In the Autumn Statement, the Chancellor announced support for low-income renters by raising the Local Housing Allowance to cover the lower 30% of rents, giving 1.6 million households an average £800 p.a. of support.

Contact us

Sell your property with your local expert this winter. Contact your local Guild Member today.

Recent News

Read What Our

Customers Say